It's easy enough to laugh off a text message notification of a compromised debit card when we're immediately prompted to fork over a social security number. Certain scams are so obvious as to be humorous, but a

recent report from the Federal Trade Commission says that identity theft and fraud are on the rise.

Cases filed with the Consumer Sentinel Network, a law enforcement database of millions of consumer complaints, rose 19 percent nationwide from 2013 to 2014, the

Times Herald reports. What's worse, Pennsylvania fell in the top third of states hit by both identity theft and fraud.

In 2014, Pennsylvania ranked 16th in the U.S. for identity theft reports, with a 17 percent increase over 2013. Fraud cases jumped by 24 percent, putting the state at a ranking of 18th in the country.

The FTC conservatively estimates that these incidents cost Pennsylvania residents at least $46 million in 2014, a figure skewed downward by the fact that only 56 percent of consumers who reported fraud revealed how much money they lost.

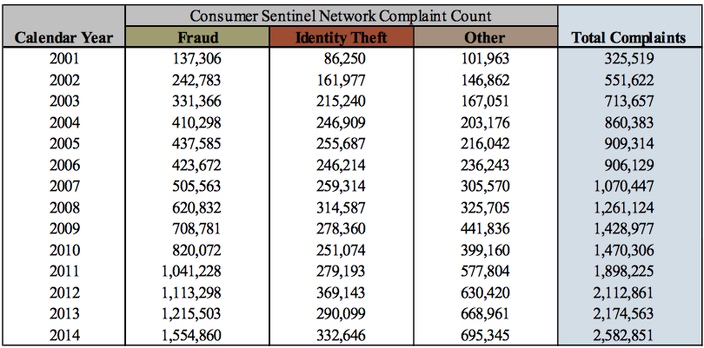

Across the United States, the total number of complaints has skyrocketed since 2001, as CSN data below reveals.

The most common type of identity theft reported in the state, accounting for 35 percent of all cases, involved government benefits, ranging from tax- and wage-related incidents to document forgery and entitlement theft. Next on the list were credit card-related incidents (16 percent) and phone/utilities fraud (13 percent).

The age demographic most likely to be targeted was Americans aged 50-59, accounting for 21 percent of all cases nationally, followed by Americans aged 40-49 and 60-69 at 18 percent each.

Fifty-four percent of all reported scams were conducted by phone, followed by e-mail at 24 percent.

What are the best ways to avoid fraud? According to a

list of tips from the FTC, the most important step consumers can take is to painstakingly verify who they are dealing with when providing personal information. Another crucial safeguard is to regularly check and review monthly statements.

If all else fails, just stay away from Florida, which ranked first in both identity theft and fraud.