June 08, 2020

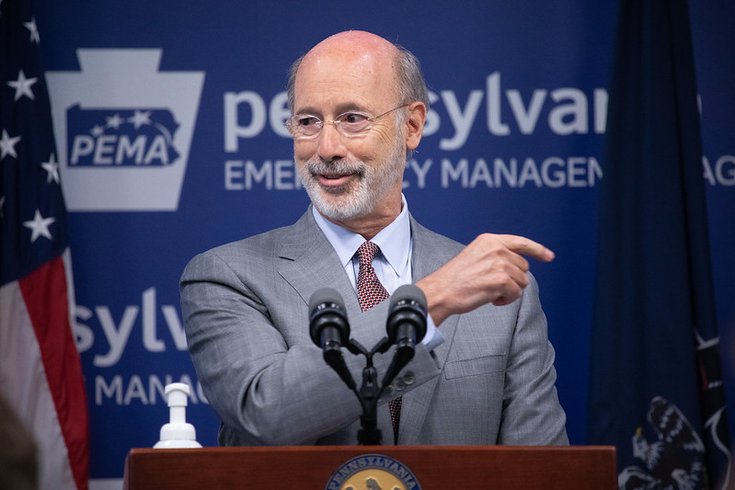

Flickr/Governor Tom Wolf

Flickr/Governor Tom Wolf

A $225 million grant program will provide economic support to small businesses in Pennsylvania that were heavily impacted by the state's shutdown order during the coronavirus pandemic.

A new state program will provide an additional $225 million in economic recovery grants to Pennsylvania's small businesses impacted by the COVID-19 crisis.

The grant program uses a portion of the $2.6 billion in federal stimulus funds Pennsylvania is receiving through the federal CAREs Act.

Funds will be distributed by the Department of Community and Economic Development to a series of 17 Community Development Financial Institutions, which will then administer grants to businesses in need.

"As we continue to navigate the COVID-19 pandemic and shift our focus toward reopening our commonwealth, we need to help all Pennsylvanians recover," Gov. Tom Wolf said Monday. "We need to provide assistance for those who were hurt by the pandemic and the resulting economic downturn. This new program will provide direct support to impacted businesses to cover operating expenses during the shutdown and the transition to reopening."

There are three different programs available to provide grants to eligible businesses. The Wolf administration outlined each in a press release:

• $100 million for the Main Street Business Revitalization Program for small businesses that experienced loss as a result of the governor’s March 19, 2020 order relating to the closure of all non-life-sustaining businesses and have or will incur costs to adapt to new business operations related to COVID-19;

• $100 million for the Historically Disadvantaged Business Revitalization Program for small businesses that experienced loss as a result of the business closure order, have or will incur costs to adapt to new business operations related to COVID-19, and in which socially and economically disadvantaged individuals own at least a 51 percent interest and also control management and daily business operations.

• $25 million for the Loan Payment Deferment and Loss Reserve Program, which will allow the CDFIs the opportunity to offer forbearance and payment relief for existing portfolio businesses that are struggling due to the impact of COVID, as well as shore up the financial position of the CDFIs that are experiencing significant increased defaults in their existing loan portfolios.

Information about how businesses can apply for these grants will be available from the DCED later this week, a Wolf spokesperson said.

"We are pleased to work with the governor on the COVID-19 Relief Statewide Small Business Assistance program to provide economic opportunities for those affected by the COVID-19 pandemic," said James Burnett, vice chairman of the Pennsylvania CDFI Network. "We know how important it is to support the smallest, most vulnerable businesses throughout the commonwealth, including historically disadvantaged and main street businesses."