May 01, 2016

Marking its 25th anniversary, Philadelphia's Center City District last week released its annual State of Center City report, which details the major trends shaping the central business district at the core of one the largest metropolitan areas in the United States.

To assess the status of a city the size of Philadelphia, it often helps to examine urban patterns in terms of neighborhoods. What the State of Center City report makes abundantly clear, however, is just how heavily our local and regional economy is driven by the job market in our central business district, an area bounded by Pine Street to the south, the Delaware River to the east, the Schuylkill River to the west, and Vine Street to the north.

State of Center City 2016.

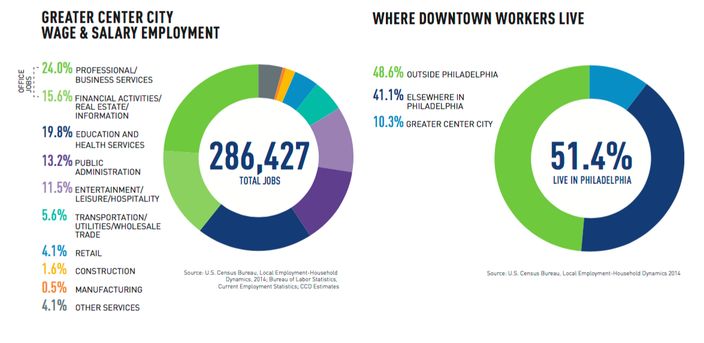

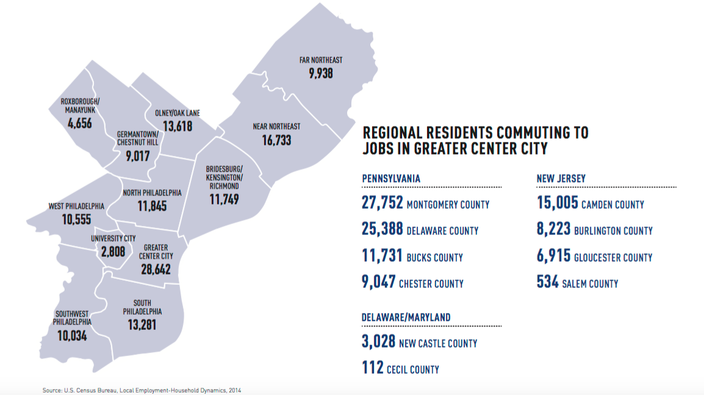

As the graphic above demonstrates, the lifeblood of Philadelphia's economy continues to be Eds and Meds, which together comprise 37 percent of citywide jobs and 20 percent of downtown employment. The largest private employer, Jefferson Health, provided 12,021 jobs in Center City in 2015 after Jefferson University Hospitals merged with Abington Health last May. That figure will increase again after Jefferson's planned merger with Aria Health, signed in principle last October, eventually takes effect over the coming year. Large networks like this, paired with a top-10 public transportation system, are among the reasons that Center City draws so many workers from across the region.

State of Center City 2016.

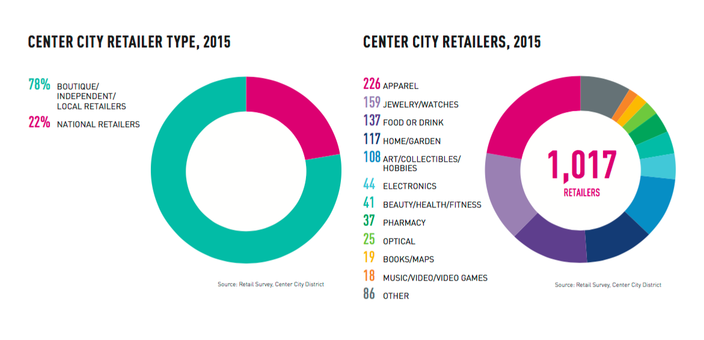

Still, the fastest-growing sector in Center City is service jobs, a trend that reflects the localization of business growth fueled by the dense concentration of workers along several central strips. As the "walkability" of cities receives greater attention as a measure of integration and desirability, Philadelphia's number four rank in the U.S. helps explain why retail and service-oriented businesses continue to take root in Center City. Professional foot traffic is at a premium and newcomers are increasingly finding residential spaces close to work. It's one of the main reasons why Philadelphia is credited for its "livability" compared to other major U.S. cities. For three straight years, more than 1,500 housing units came to market in Center City, providing places to live for a full quarter of new Philadelphia residents between 2010-2014.

State of Center City 2016.

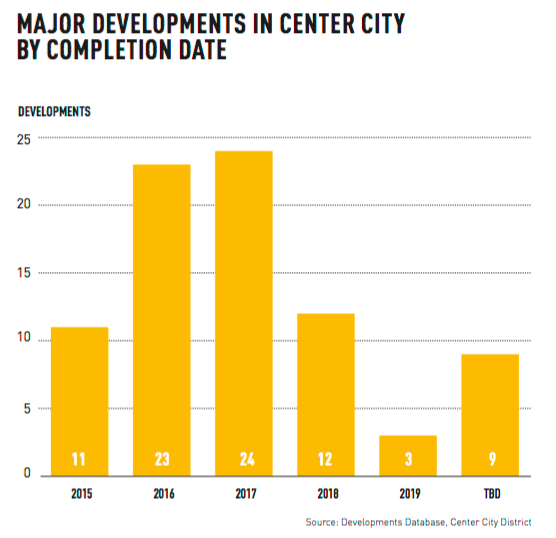

Another trend driving short- and potentially long-term growth in Center City — and throughout Philadelphia — is the expansion of co-working spaces that attract startups and other firms on their way to a more permanent presence. As the report notes, these spaces, including two of Center City's largest on the way from Make Office, act as incubators that provide a means for tenants to test the Philadelphia market. Tourism, events and conventions, meanwhile, gave the city its highest hotel occupancy rate in recent years at 76.7 percent. The next three years alone will see the completion of 59 major new developments in Center City.

State of Center City 2016.

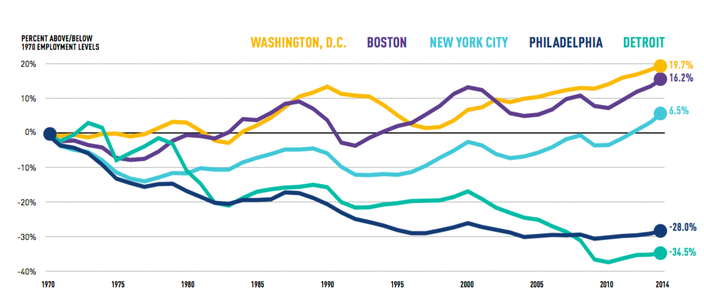

Office occupancy in Center City climbed from 86.7 percent in 2014 to 88.5 percent in 2015, with an average asking rent of $27.44/sf, markedly lower than Midtown Manhattan ($80.97), Boston ($55.60) and Washington, D.C. ($51.35.). The flip-side to this has been somewhat stagnant private sector job growth, just 0.9 percent annually since the 2008 Recession compared to an average of 2.7 percent among the 25 most populous cities in the U.S. Since 1970, Philadelphia's total wage and salary employment has actually declined by 28 percent, putting it near the company of Detroit.

State of Center City 2016.

The Center City District also took a look at results from a 2015 Parks Intercept Survey of 570 Philadelphia respondents who were asked to weigh in on the addition of new green spaces and provide suggestions for how to make Center City a better place to do business. While a vast majority of those surveyed said they feel safe in Center City and believe it is cleaner than other parts of Philadelphia, most said fixing sidewalks, improving streets and alleys and adding landscaping should be priorities.

To improve Center City's business climate, those surveyed pointed to three of Philadelphia's most longstanding issues: 72 percent said the city's public schools need to be improved, 66 percent said lawmakers need to reduce the city's wage tax and 37 percent said the business tax has to be lowered. In a Center City Digest essay attached to the report, Center City District CEO Paul Levy argues that tax reform is crucial to supporting job growth in Philadelphia to capitalize on an otherwise healthy economy.

The full 2016 State of Center City report, which offers troves of charts and detailed data, can be accessed here.

Source/Center City District

Source/Center City District Source/Center City District

Source/Center City District  Source/Center City District

Source/Center City District Source/Center City District

Source/Center City District Source/Center City District

Source/Center City District