January 14, 2026

Independence Blue Cross (IBX) offers members more than just traditional health insurance. Discover how IBX employee and health plan member, Aaron, and his wife, Carmen, maximized their health savings by choosing a high-deductible health plan (HDHP) with a health savings account (HSA) and leveraging AblePay’s medical bill reduction services. Their choices helped them save nearly $900 — money they could put toward starting their family.

As an IBX employee and health plan member, Aaron understood the various plan options available to him and his wife, Carmen. After doing some research and considering their health history and future family planning needs, they selected an IBX high-deductible health plan (HDHP) with a Health Savings Account (HSA) for the 2024 benefit year. Through their IBX health plan, they were also able to take advantage of the no-cost medical bill reduction services provided by AblePay, helping them manage expenses and plan confidently for future health care needs.

Key factors that influenced their decision:

• Health history: Aaron and Carmen are young, healthy, and active individuals with a history of minimal health care needs, which played a significant role in choosing an IBX HDHP with an HSA.

• Tax advantages: The tax benefits of an HSA plan appealed to them.

• Contributions: They valued the freedom to use money in their HSA for both health and financial needs, including investment opportunities.

• Investment strategies: They liked the idea that an IBX HDHP with an HSA offers several investment options they could take advantage of.

The HSA also allows them to set aside pre-tax dollars for current and future health care expenses. This was especially beneficial as they were planning for a baby and wanted to ensure they had the funds available for any immediate or long-term needs.

In 2024, they elected to contribute the maximum allowable amount for the family coverage tier to maximize both their saving and investment opportunities.

Common qualifying expenses*

• Copays, deductibles, and coinsurance

• Prescriptions

• Dental exams, X-rays, and orthodontia

• Vision exams, frames, and contact lenses

• Physical therapy and chiropractic care

• First aid kits

• Over-the-counter medications

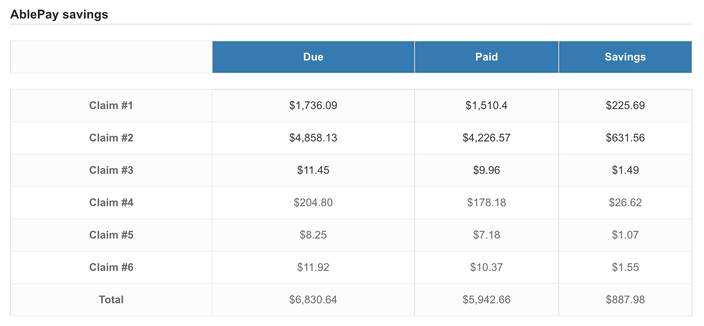

When their dreams of parenthood became a reality, Aaron and Carmen used their HDHP with HSA and AblePay for all of Carmen’s OB-GYN and maternity visits. The combination provided them with excellent care and significant savings. They ended up saving almost $900 using AblePay and their HDHP with HSA. Additionally, there was no extra paperwork or claim submissions required when using AblePay, making for a seamless experience.

Ready to maximize your health care savings? Learn more and enroll with AblePay.

*Refer to IRS publications 969, 502, and code section 213(d). These publications are available at irs.gov for further guidance.

This content was originally published on IBX Insights.The IBX Insights Team is here to provide tips on using your health insurance and living a healthy life.