November 16, 2016

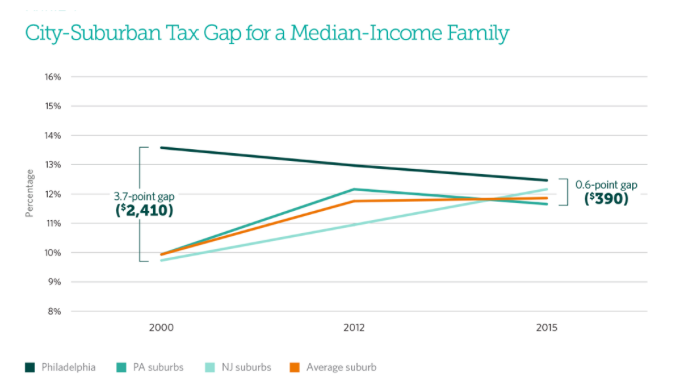

One of the most frequently cited deterrents to living in Philadelphia, or any other big city, is the assumed disparity in tax burden that individuals and families will face as an added cost of dwelling in a dense population center. Suburban life, many have concluded, is more favorable to cumulative savings.

New research from the Pew Charitable Trusts suggests this drawback isn't nearly as big as was 15 years ago. The tax gap between Philadelphia and its suburbs has closed by about three full percentage points over that timeframe for middle-income families. Tax burden, for clarification, is defined as the percentage of gross income that the family would owe on the major nonfederal taxes: state and local income taxes, state and local sales taxes, and local property taxes.

As recently as 2012, when Pew first observed and reported on the trend, the average city-suburban tax gap was 1.2 percentage points — or about $750 in taxes per year. That fell to 0.6 percentage points, about $390, in the past three years alone.

Source/Pew Charitable Trusts

Source/Pew Charitable Trusts Tax gap between Philly and surburbs (200-2015).

Source/Pew Charitable Trusts

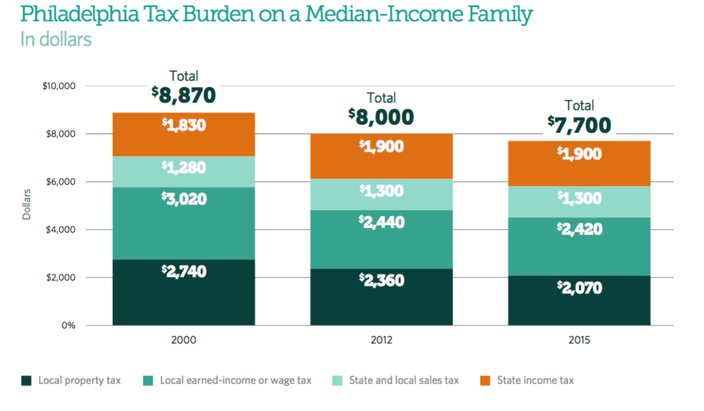

Source/Pew Charitable Trusts Philadelphia tax burden on median-income family ($37,460 per year).

Among all municipalities included in the study, Philadelphia came in with the 97th highest tax burden. More impressively, the city's tax burdened dropped from third-heaviest in 2000 to 59th-heaviest among in 2015 among the 100 poorest communities in the area, though some have questioned whether the new sweetened-beverage tax will disproportionately affect lower-income Philadelphians.

Compared to the study's wealthier communities that attract higher earners, Philadelphia still had the 10th-heaviest tax burden in 2015.

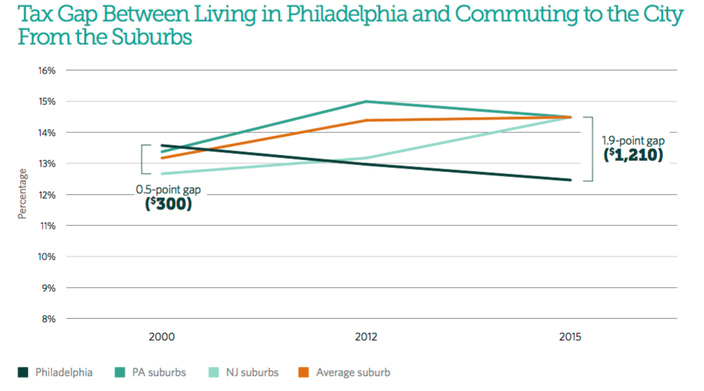

Some of the reports findings defy popular belief, particularly about commuting. Suburban homeowners who work in Philadelphia saw a 0.5 percentage-point gap ($300) increase to a 1.9-point gap ($1,210) compared to those living in Philadelphia.

Source/Pew Charitable Trusts

Source/Pew Charitable TrustsTax gap between commuting to and living in Philly.

Where are the best and worst places to live in terms of tax burden in 2015? In Pennsylvania, the best is Bryn Athen Borough in Montgomery County and the worst is Colwyn Borough in Delaware County. In New Jersey, Lower Alloways Creek Township in Salem County had the lightest tax burden, while Woodlynne Borough in Camden County had the highest tax burden.

Further analysis and graphs can be found in the full report from the Pew Charitable Trusts.